Securing a business loan can be a daunting task, especially for entrepreneurs launching a new venture with little to no revenue. However, with the right approach and understanding of the available loan options, it is possible to obtain the necessary financing to kickstart your small business. In this article, we’ll explore the various strategies and best practices to help you navigate the loan application process and increase your chances of securing a startup business loan, even with limited capital.

Key Takeaways

- Understand the loan options available for startups with no revenue or money, such as microloans, equipment financing, and invoice financing.

- Craft a compelling business plan that showcases your business idea, financial projections, and repayment ability.

- Leverage your personal credit score and any available collateral to improve your chances of loan approval.

- Carefully evaluate the loan terms, including interest rates, repayment schedules, and any penalties or fees.

- Commit to responsible borrowing practices and closely monitor your cash flow to ensure timely repayment of the business loan.

Understanding Startup Business Loans

Securing the necessary capital is a critical component for any startup’s success. Business loans are a popular financing option for entrepreneurs looking to launch or expand their ventures, even in the early stages. Understanding the unique aspects of startup business loans can help aspiring business owners navigate the application process and ensure they obtain the funding they need to turn their vision into reality.

What is a Startup Business Loan?

A startup business loan is a type of financing tailored specifically for businesses that have been operating for less than two years. These loans provide the necessary funds to help new enterprises get off the ground, cover initial expenses, and support growth in the early stages. Unlike traditional small business loans, startup loans often have more flexible requirements and may be available to companies without an established credit score or extensive business credit history.

Importance of Capital for Startups

Access to financing is paramount for startups. New businesses frequently require significant upfront investments to cover costs such as leasing office space, purchasing equipment, hiring employees, and funding marketing efforts. Startup business loans can provide the necessary capital to help entrepreneurs bridge this critical gap and set their businesses up for long-term success.

Loan Process and Requirements

Obtaining a startup business loan typically involves a thorough application process. Lenders will often examine the strength of the business plan, the entrepreneur’s personal credit score, any available collateral, and the overall viability of the venture. While requirements may vary, startups without a lengthy business history or significant revenue may need to demonstrate their potential through detailed financial projections and a compelling narrative about their market opportunity and competitive advantages.

Business Loan Options for Startups with No Money

For startups with limited capital, securing financing can be a significant challenge. However, there are several alternative loan options available that can provide the necessary funding to get your business off the ground. Let’s explore some of the key options: microloans, equipment financing, and invoice financing and factoring.

Microloans

Microloans are small-scale loans, typically up to $50,000 or less, that are often issued by nonprofit organizations and community development financial institutions (CDFIs). These loans are designed to support businesses in underserved communities, providing access to affordable financing. Compared to traditional bank loans, microloans tend to have more lenient requirements and can be an excellent option for startups with limited financial history or collateral.

Equipment Financing

For startups in need of specialized equipment, equipment financing can be a viable solution. In this type of arrangement, the lender provides the funds to purchase the necessary equipment, and the equipment itself serves as collateral for the loan. This can be particularly beneficial for startups, as it allows them to acquire essential assets without requiring a significant upfront investment or traditional business credit history.

Invoice Financing and Factoring

Invoice financing and factoring are two additional financing options for startups with limited resources. Invoice financing leverages a business’s unpaid invoices as collateral, allowing the startup to access a portion of the outstanding payments. Factoring, on the other hand, involves selling the unpaid invoices to a third-party factoring company, which then provides the startup with a lump sum of cash. Both of these strategies can help startups manage their cash flow and obtain the necessary funding to continue operations.

These alternative loan options provide startups with innovative ways to access the capital they need to grow and thrive, even in the absence of a significant financial history or substantial collateral. By exploring these diverse financing options, startups can find the right solution to support their unique business needs and overcome the challenges of launching a new venture.

Building a Strong Loan Application

When seeking a startup business loan with no money, crafting a compelling application is crucial to securing funding. The foundation of a successful loan application lies in three key components: a well-articulated business plan, a clear and compelling business idea, and a strong personal credit score supported by available collateral.

Crafting a Compelling Business Plan

A well-crafted business plan serves as the backbone of your loan application. It demonstrates to lenders your deep understanding of the market, your competitive landscape, and your strategy for attracting and retaining customers. Lenders pay particular attention to your financial projections, which outline your expected revenues, costs, and profits. A detailed, realistic, and well-researched business plan can significantly improve your chances of loan approval.

Highlighting Your Business Idea

In addition to the business plan, lenders also closely examine the business idea itself. They want to see a unique and innovative concept that has the potential to thrive in the market. Your application should clearly communicate the problem your business solves, the value it provides to customers, and your competitive advantages over existing offerings.

Personal Credit Score and Collateral

If your startup has no revenue or credit history, lenders often look to the personal credit score of the business owner as an indicator of creditworthiness. A strong personal credit score can significantly increase your chances of loan approval, as it signals to lenders a history of responsible credit behavior. Furthermore, lenders may consider any collateral, such as personal assets or large equipment, that you can offer to secure the loan and mitigate their risk.

Business Loan

Just like planting a seed requires water and sunlight, nurturing a startup requires capital. Small business loans are specifically designed to provide this financial nutrient. They are loans offered by online lenders, traditional banks, investors and credit unions to aid entrepreneurs in launching their businesses.

The process usually involves borrowers presenting a detailed business plan, including financial projections, a loan application and potentially some collateral. The lender examines your plan, gauges the potential success of your venture and decides on the loan amount, interest rates and repayment terms.

| Loan Type | Loan Amount | Interest Rate | Repayment Term |

|---|---|---|---|

| Business Line of Credit | Up to $250,000 | 8% – 25% | 6 months – 5 years |

| Term Loan | $5,000 – $500,000 | 6% – 30% | 1 – 5 years |

| SBA Loan | Up to $5 million | 7.5% – 12% | Up to 25 years |

This table outlines some common business loan options, including the typical loan amount, interest rate, and repayment term. The specific terms can vary depending on the lender, your business credit, and other factors.

Alternative Funding Sources

As an entrepreneur, securing startup financing can be a daunting task, especially if your business lacks revenue or collateral. However, there are alternative funding options beyond traditional business loans that can provide the capital you need to get your venture off the ground.

Business Credit Cards

A business credit card can be a valuable tool for startups, offering access to financing and helping to establish your company’s credit profile. While cash flow is important, many credit card issuers focus more on the personal creditworthiness of the business owner. To qualify for most cards, you’ll generally need a good personal credit score, typically 690 or higher.

Crowdfunding Platforms

Crowdfunding has emerged as a popular way for startups to raise funds from a large pool of individual investors. By creating a compelling campaign on platforms like Kickstarter or Indiegogo, you can tap into the power of your community to secure the necessary financing to bring your business idea to life. This type of equity financing can provide the capital you need without the burden of traditional debt.

Angel Investors and Venture Capitalists

For startups with a strong, innovative business model, angel investors and venture capitalists can be a valuable source of funding. These individuals and firms invest in early-stage companies, often in exchange for equity or a stake in the business. While the application process can be competitive, securing funding from these sources can provide not only capital but also valuable guidance and mentorship to help your startup succeed.

Exploring these alternative funding sources can open up new opportunities for startups looking to overcome the challenge of obtaining traditional business loans. By diversifying your financing options, you can increase your chances of securing the necessary capital to turn your entrepreneurial dreams into reality.

Evaluating the Need for a Loan

When seeking a business loan, it’s crucial to carefully evaluate your financing needs and understand what a lender is looking for. Even if your startup lacks revenue, there are several positive attributes you can offer to increase your chances of loan approval.

One key factor that can improve your loan application is offering collateral. Whether it’s large equipment, real estate, or cash, providing lenders with secured assets shows your commitment and helps mitigate their risk. Additionally, having a cosigner who can take over repayments if needed can also strengthen your case.

Meeting a lender’s specific requirements is another important step. This may involve demonstrating a solid business plan, highlighting your business idea, and showcasing your personal credit score and business credit history. By addressing these key elements, you can enhance your financing options and increase the likelihood of securing a startup business loan, even without extensive revenue or time in business.

Ultimately, understanding the lender’s perspective and highlighting your strengths can go a long way in securing the funding your small business needs to thrive.

Demonstrating Repayment Ability

Securing a startup business loan hinges not only on your business idea but also on your ability to demonstrate your repayment capacity. Lenders scrutinize several key financial metrics to assess your creditworthiness and the likelihood of timely loan repayments.

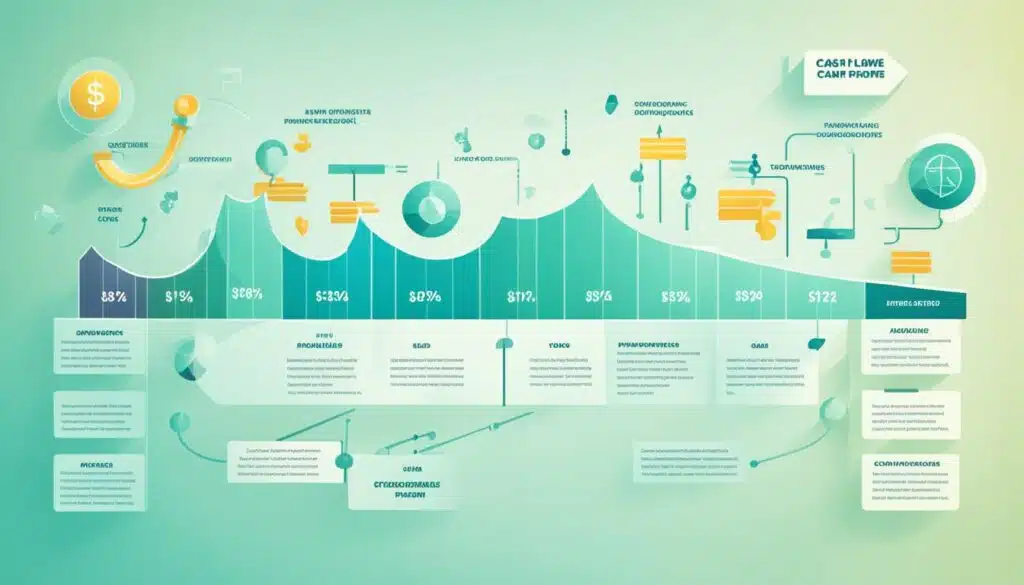

Cash Flow Management

Be meticulous with your cash flow management. With a loan to repay, you’ll need to have a firm grasp on your revenue and expenses so that your business can meet all its financial obligations. Maintaining a healthy cash flow is crucial for ensuring your debt payments are made on time.

Debt-to-Income Ratio

Lenders often use the debt-to-income ratio (DTI) to evaluate your repayment ability. This ratio is calculated by dividing your monthly debt payments by your monthly gross income. A lower DTI indicates a stronger financial position and a higher likelihood of repaying the loan.

Debt Service Coverage Ratio

Another metric lenders may consider is the debt service coverage ratio (DSCR). This ratio uses your net revenue or EBITDA (earnings before interest, taxes, depreciation, and amortization) divided by your monthly debt payments. A DSCR of 1.0 or higher suggests your business has sufficient cash flow to cover its debt obligations.

| Metric | Formula | Interpretation |

|---|---|---|

| Debt-to-Income Ratio (DTI) | Monthly Debt Payments / Monthly Gross Income | A lower DTI indicates stronger financial standing and higher likelihood of repaying the loan. |

| Debt Service Coverage Ratio (DSCR) | Net Revenue or EBITDA / Monthly Debt Payments | A DSCR of 1.0 or higher suggests sufficient cash flow to cover debt obligations. |

By demonstrating your ability to manage cash flow, maintain a healthy debt-to-income ratio, and achieve a favorable debt service coverage ratio, you can increase your chances of securing a startup business loan, even without established revenue.

Mitigating Lender Risk

When seeking a startup business loan with no revenue or collateral, it’s crucial to address the lender’s primary concern: risk. Lenders need assurance that you can repay the loan, and they may look for ways to minimize their exposure to lender risk. Two effective strategies to achieve this are offering collateral and providing a personal guarantee.

Offering Collateral

Securing your loan with collateral, such as large equipment, real estate, or cash, can significantly improve your chances of getting approved, even if your business lacks a track record or revenue. Offering collateral provides the lender with a tangible asset they can seize in the event of a default, effectively reducing their risk. This can also help you secure better interest rates and more favorable repayment terms.

Personal Guarantees

Another way to mitigate a lender’s risk is by providing a personal guarantee. This involves enlisting another individual, often the business owner, to take responsibility for the loan payments should the business be unable to make them. By adding a personal guarantee, you’re essentially offering the lender an additional layer of security, which can be a crucial factor in securing startup financing.

Addressing a lender’s concerns about risk through collateral and personal guarantees can significantly improve your chances of obtaining a startup business loan, even in the absence of revenue or a lengthy track record.

Considering Loan Terms and Fees

As you explore various loan options for your startup, it’s crucial to closely examine the loan terms and associated fees. Understanding the interest rates, repayment schedules, and potential penalties or additional costs can help you make an informed decision and ensure your business can comfortably meet its financial obligations.

Interest Rates

The interest rate on your loan can significantly impact your overall repayment costs. Some loans may offer fixed interest rates, providing predictability in your monthly payments, while others may have variable rates that can fluctuate over time. Carefully evaluate the interest rate structure to determine the best fit for your business’s financial situation and cash flow projections.

Repayment Schedules

The repayment schedule dictates the frequency and duration of your loan payments. Consider the impact of the repayment schedule on your business’s cash flow and ability to meet other financial obligations. Longer loan terms may provide lower monthly payments, but could result in higher overall interest costs over the life of the loan.

Penalties and Additional Costs

Carefully review the loan agreement for any penalties or additional costs associated with the loan. Some lenders may impose penalties for early repayment or late payments, which can add to the overall cost of the loan. Additionally, there may be origination fees, appraisal fees, or other administrative fees that should be factored into your loan considerations.

| Loan Term | Interest Rate | Repayment Schedule | Penalties and Fees |

|---|---|---|---|

| 3 years | 8.5% fixed | Monthly payments | $250 origination fee, $50 late payment fee |

| 5 years | 7.9% variable | Quarterly payments | $500 prepayment penalty |

| 2 years | 10% fixed | Weekly payments | $150 application fee, $75 annual fee |

Responsible Borrowing Practices

As a business owner seeking a startup loan, it’s crucial to embrace responsible borrowing practices. By aligning your lending decisions with your business stability and cash flow management, you can navigate the repayment process with confidence and success.

One key aspect of responsible borrowing is debt management. Ensure that the loan amount you seek matches your business’s repayment capacity, based on your comprehensive financial projections. Overextending yourself can jeopardize your business stability and make it challenging to meet your obligations.

Additionally, closely monitor your cash flow to maintain a clear understanding of your business’s financial health. This will not only help you make informed decisions about your loan but also enable you to adapt your strategy as needed to stay on track with your repayment schedule.

Remember, your startup loan was approved based on your business plan, so adhere to it as closely as possible. Deviating significantly from your plan can lead to business instability and make it difficult to fulfill your debt management commitments.

By embracing these responsible borrowing practices, you can borrow with confidence, maintain business stability, and ensure a smooth repayment process that supports the long-term success of your startup.

Also Read: How To Get A Startup Business Loan With No Money?

Conclusion

As an aspiring business owner, securing a startup business loan can be a crucial step in transforming your entrepreneurial dreams into reality. Whether you’re looking to launch a new venture or expand an existing one, understanding the various loan options, the application process, and the strategies for demonstrating your creditworthiness are essential for securing the necessary financing.

From microloans and equipment financing to invoice factoring and alternative funding sources like business credit cards and crowdfunding platforms, there are numerous avenues to explore when seeking startup capital. By crafting a compelling business plan, highlighting your unique business idea, and leveraging your personal credit score and available collateral, you can increase your chances of securing a favorable business loan.

Remember, responsible borrowing practices, including meticulous cash flow management and a keen awareness of debt-to-income ratios and debt service coverage ratios, can help you navigate the loan process successfully. By mitigating lender risk through collateral and personal guarantees, and thoroughly understanding the loan terms and associated fees, you can make informed decisions that align with your business goals and financial capabilities.

With the right approach and a solid understanding of the startup business loan landscape, you can unlock the funding necessary to turn your entrepreneurial vision into a thriving reality. Embrace the journey, stay diligent in your preparations, and let your passion for your business guide you towards a successful and sustainable future.

FAQs

Q: How can I get a startup business loan with no money?

A: While getting a startup business loan without any money may be challenging, there are some options available for new entrepreneurs. You can look into microloans, personal loans, crowdfunding, or secure a loan with collateral.

Q: What are the best small business loans available for startups?

A: Some of the best small business loans for startups include SBA loans, business lines of credit, term loans, and equipment financing.

Q: What do I need to apply for a business loan?

A: To apply for a business loan, you typically need a solid business plan, financial statements, proof of income, credit history, and sometimes collateral depending on the type of loan.

Q: How can I determine the type of small business loan that suits my business needs?

A: To determine the type of small business loan that fits your needs, consider factors like the amount of funding required, repayment terms, interest rates, and whether you need a short-term or long-term loan.

Q: What are the financing options available for small business owners?

A: Small business owners can explore options such as term loans, lines of credit, SBA loans, equipment financing, or business credit cards to meet their financing needs.

Q: How do I apply for a business line of credit?

A: To apply for a business line of credit, you will need to submit a detailed business plan, financial statements, proof of income, and demonstrate your business’s ability to repay the credit line.

Q: What are the requirements to qualify for a small business administration (SBA) loan?

A: To qualify for an SBA loan, you typically need to have a good credit score, meet the SBA size standards, provide a solid business plan, and be able to demonstrate repayment ability.